What Is the Time Value of Money?

The time value of money is the idea that money today is generally worth more than the same amount of money in the future. Would you prefer to get paid $1,000 or $1,000 one year from today? Most people would choose to get paid today. The three main reasons people would want to get paid today are inflation risks, time risks, and opportunity costs of not being able to deploy the cash in other ways. However, what if you were offered $1,000 today or $1,200 a year from now for the same item? Which should you take? To make the best decision, you will need to understand the time value of money.

Understanding TVM is part of the very foundation of investing. The big but straightforward idea is that if the value of the money in the future will be greater than the present value, it is called an investment. If the value of the money is less valuable in the future, that is called inflation. As obvious as it sounds, it is worth mentioning that it is not wise to allocate capital where the future value will be less than it is today and why most investors don’t want to hold too much cash.

Companies of all sizes use mathematical formulas to compute the TVM of projects over extended periods to decide how to allocate capital. For example, companies would use TVM as part of their decision matrix to decide if they should build a new plant or buy a competitor already producing the item? Both options may produce a profitable result, but what is the better allocation of funds and resources. It can be a little overwhelming to think about but understanding the decision matrix of big corporations can help individual investors decide where to allocate their investment capital.

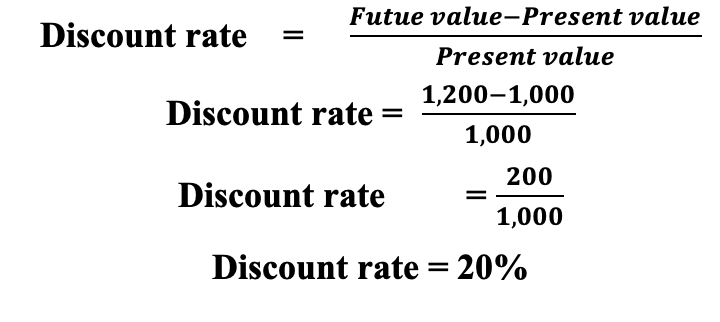

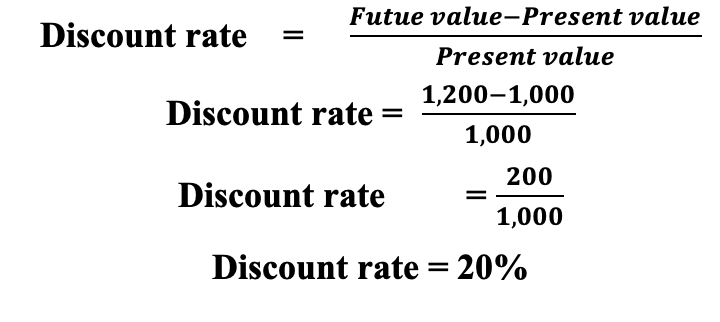

The financial industry generally understands TVM in terms of present value, future value, and discount rate. The present value and future value of the money are easy to understand. In our example, the present value is $1,000 today, and the future value is $1,200 . The term discount rate is sometimes called the rate of return or the interest rate. The discount rate is the difference in percentage from the present value to the future value. In our example, the discount rate (rate of return) is 20%. The decision matrix will involve several factors to decide if it is a good investment. Some of those factors could be the credit worthiness of the payer, liquidity and cash requirements, time risks, economic factors, and how it fits into the total investment strategy.

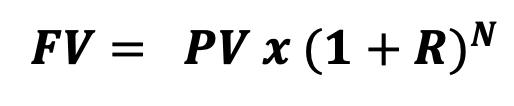

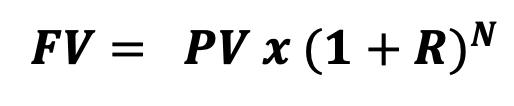

There is an equation finance professionals use to determine the TVM.

The math is not very complicated when there is only one period (i.e., one year) or it is a simple interest. However, if multiple periods or compounding are involved, it is more important to understand how time affects the math. We will only add one variable to our equation, but it can become more complicated than this article. Finance professionals use the variable N for time (number of periods).

PV= Present Value, FV= Future Value, R= Discount Rate (Rate of Return), N=Number of periods

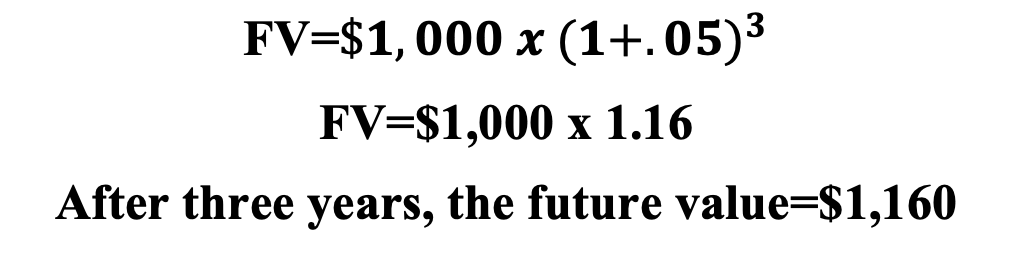

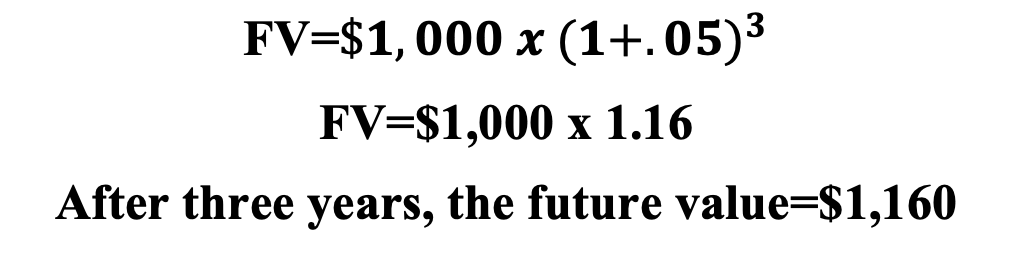

Let's say we are trying to find the future value of an investment three years from now. The present value is $1,000. The discount rate (rate of return) is 5% per year. The math would look like this:

PV=1,000 R=.05 N=3

It does get more complicated, but this equation is the basis for projecting the time value of money. The TVM equation helps investors make decisions and requires three variables.

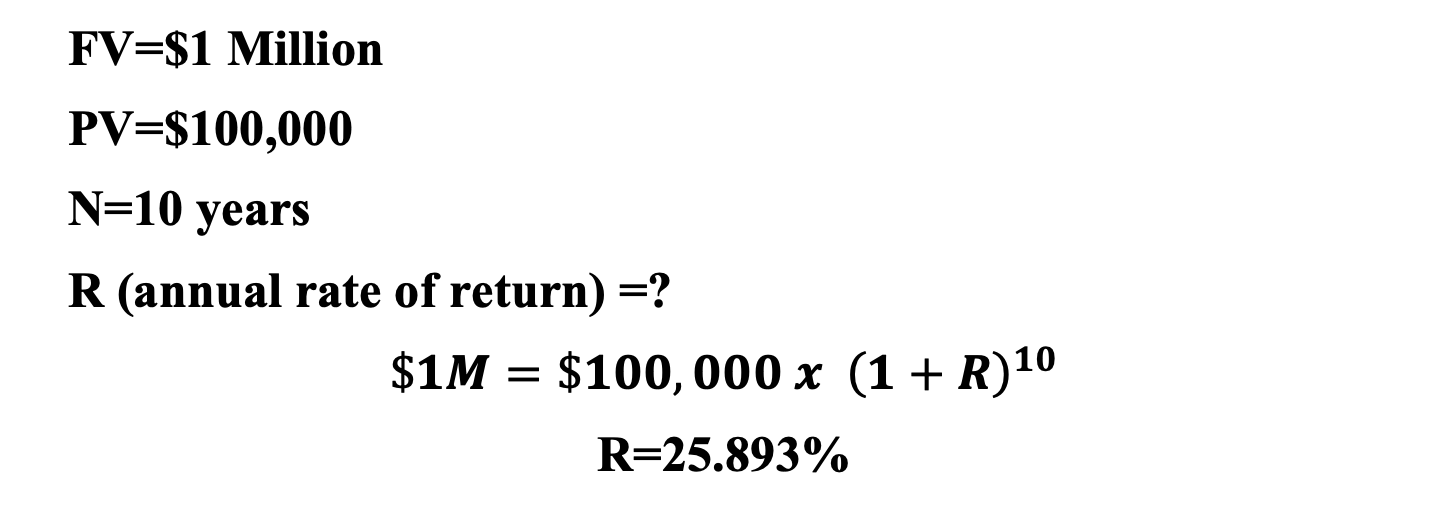

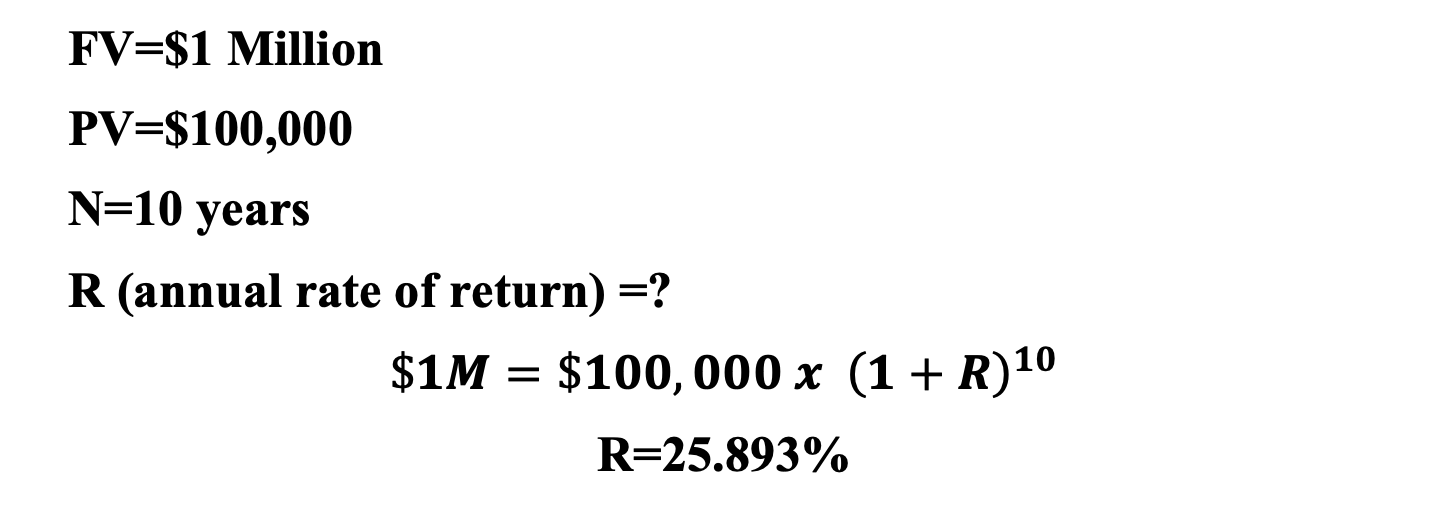

For example, if one wants to make $1 million in 10 years and currently has $100,000, what would you need your investments to return every year?

Financial calculators make the math easy. Many free online options or financial calculators are available at most large general retailers like Amazon, Walmart, and Target. The answer would be 25.893% per year be needed to turn $100,000 into $1 million over ten years. If your objective is not flexible or changeable, it won't make sense to make any investment if the projected annual return is less than 25.893%.

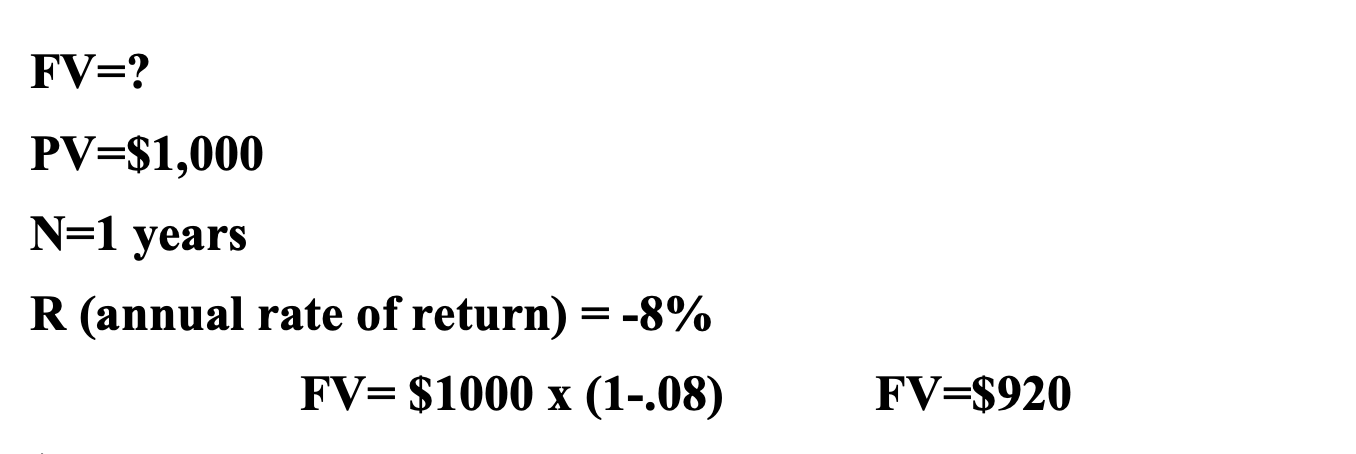

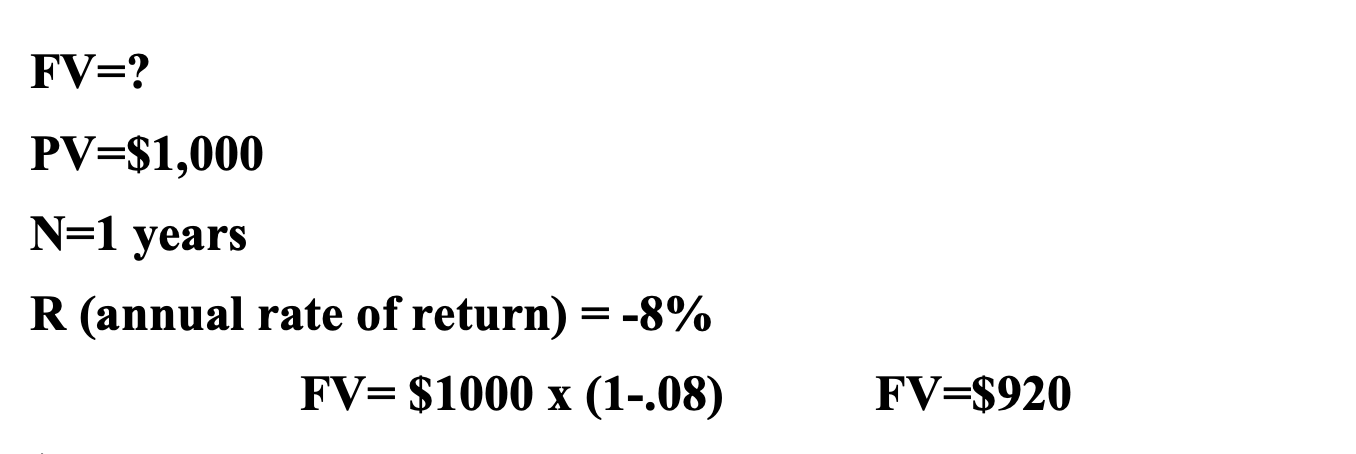

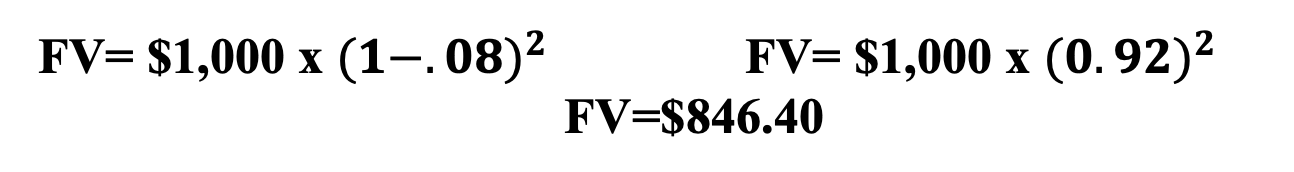

This equation also predicts the loss of purchasing power due to inflation. When inflation is higher than the discount rate (rate of return), the TVM becomes negative, which means future dollars are worth less than today's dollars. When the TVM is negative, people will say there is a "loss of purchasing power." If inflation is 8% for one year, the equation will look like this:

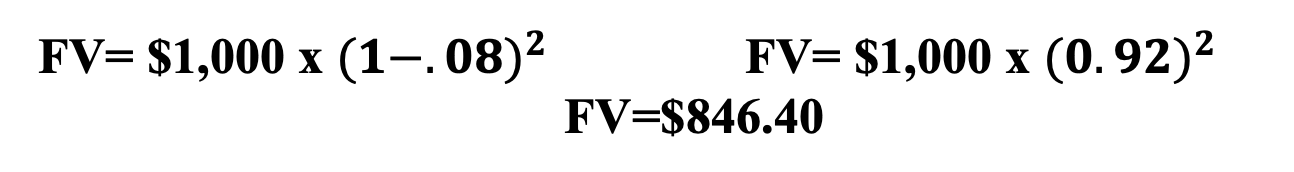

$1,000 that has been sitting in the bank for the last year now only has the purchasing power of what $920 could purchase one year ago. If we somehow knew inflation would continue at the 8% rate for another year, our equation would have looked like this:

$1,000 in the bank last year and left there until one year from today will be worth $846.40 in last year’s dollars. If you don't have your money in an asset to keep up with inflation, the TVM is working against you, not for you.

Calculator.net has an excellent online financial calculator and a thorough explanation of TVM

It is essential to understand TVM to build a portfolio that outpaces inflation and reaches investment objectives. Before the TVM can help you decide how to reach objectives, you must define what objectives you are trying to achieve. In our example, the investor’s objective was to turn $100,000 into $1 Million in 10 years. The TVM equation revealed they need to grow their money by at least 25.893% annually to reach the goal. However, this number does not consider inflation, which is only nominal growth. It is not an accurate understanding of the increase in purchasing power. The real rate of return is the annual rate minus the inflation rate.

The average annual inflation-adjusted stock market return over the last 50 years is 5.4%. Finding assets that keep the TVM equation positive when inflation is high can be challenging.

Most people don’t realize there is an asset class that consistently has a positive double-digit TVM and has outpaced inflation even when the stock market is down. The asset is Investment Grade Coins. Investment Grade Coins do not trade on their weight. Instead, they trade on their rarity. Investment Grade Coins do not compare well to paper assets. A better comparison will be ocean-front real estate, antique automobiles, or fine art. People tend to be willing to pay more for these assets because of their rarity, and the Investment Grade Coins behave much the same way.

Here is the historical performance of Gold American Buffalo PF70 Investment Coins. If this type of price growth aligns with your investment goals, it may be worth a short conversation with one of our precious metal experts to learn more about how Investment Grade Coins could help you keep your TVM positive.

Call Today for your Complimentary Consultation!

(800) 694-3518