- Gold $0.00 $0.00

- Silver $0.00 $0.00

- Platinum $0.00 $0.00

- Palladium $0.00 $0.00

Is Your Investment Portfolio Out Of Balance?

A Smart Asset Allocation Strategy Can Minimize Risk and Maximize Returns

Don't put all your eggs in one basket!

We have all heard this adage, and it's simple when you begin, but the solution to keeping your eggs safe over the long haul is a bit more complicated than you may think.

Splitting your eggs (investment capital) between more than one basket (investment vehicles) is a good way to start any portfolio, but it's just as important to monitor the performance of your different investments over time, because your baskets change, and you can end up with more eggs in a basket than you might be aware of, and too few in another.

Since the value of different "eggs" changes over time as markets ebb and flow, your investment portfolio can end up looking lopsided. This type of portfolio is said to be "unbalanced," even if it was "balanced" when it was created. The key to maintaining a healthy portfolio, then, is to rebalance the assets as their values change.

For example, if Basket A grows from 5 eggs to 8, and Basket B shrinks from 5 eggs to 2, you need to move some eggs from Basket A to Basket B to maintain your initial diversified position, and restore portfolio balance. This strategy is designed to reduce risks, increase gains, and protect your investment portfolio over the long-term.

Rebalancing Made Easy

The strategy of dividing your investment portfolio across different asset classes such as precious metals and other investments (stocks, bonds, real estate, etc.) is what is known as “asset allocation." Market performance, change in your risk tolerance, or a shift in your long-term goals are all good causes to rebalance your portfolio, to ensure your allocation levels are on target and your investments are well diversified.

Understanding the strategy and purpose of rebalancing is key to achieving the right asset mix and maintaining it. Simply put, rebalancing means re-distributing your investments among different asset classes by moving funds between the investments in your portfolio to retain your target relative allocation levels.

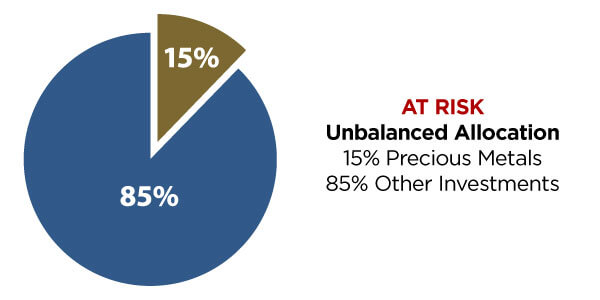

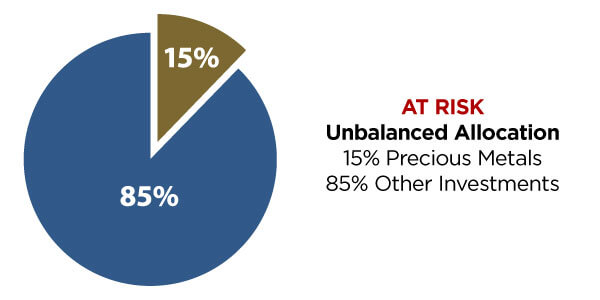

Let's look at a hypothetical investment portfolio below:

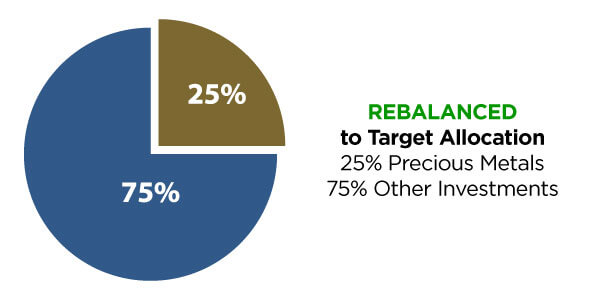

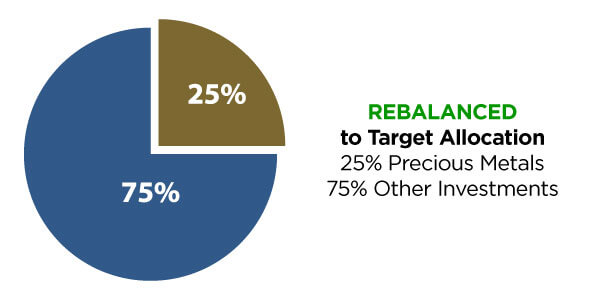

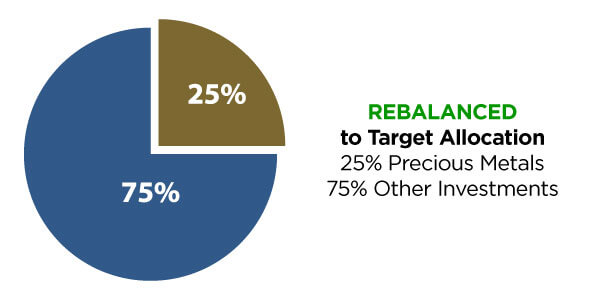

- An initial allocation was created with 25% precious metals and 75% other investments (stocks, bonds, fixed income, real estate, etc.) -- a wise diversification strategy.

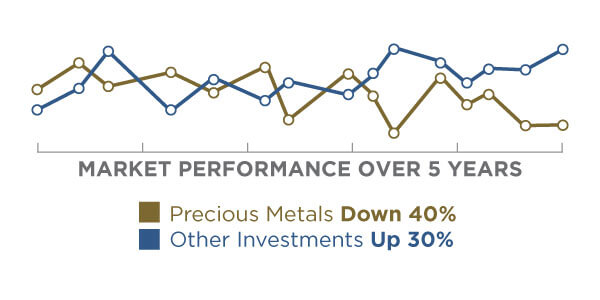

- Over the next 5 years, market performance shifted the portfolio off its target allocation to 15% precious metals and 85% other investments.

- This market performance shift moved the investment portfolio away from its initial target allocation. What started as a balanced portfolio is now out-of-balance.

- By redirecting 10% from the over-performing asset to the under-performing asset, the portfolio is once again rebalanced and back on target.

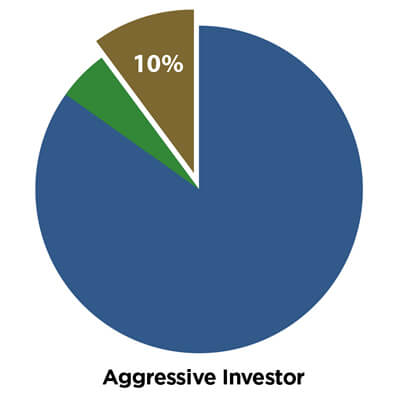

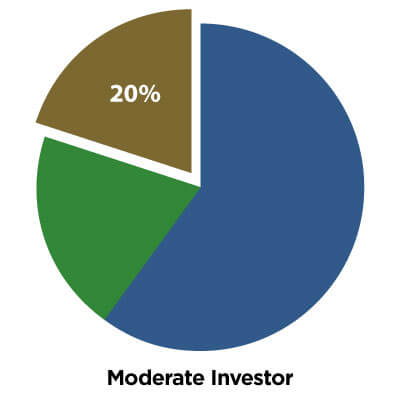

What Balance is Right for You?

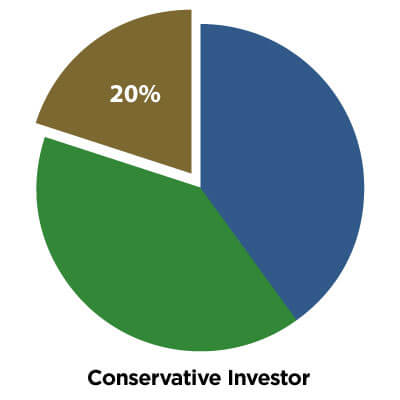

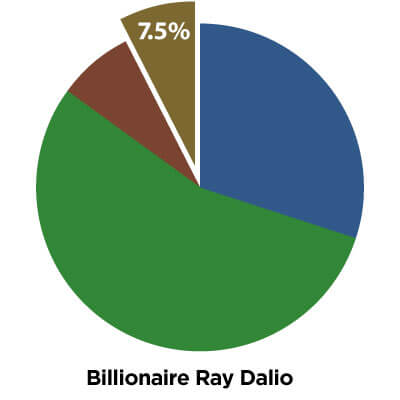

Investors need to consider their time horizon, risk for tolerance, long-term objectives and available capital to develop a strong allocation strategy as each asset class has different levels of risk and reward. For example, an investor with a short time horizon and low tolerance for risk may feel more secure with a, conservative approach, whereas an investor who has a longer time horizon may find an aggressive approach to be more suitable.

Below is a series of sample portfolios. Each model contains different proportions of asset classes catering to a particular level of risk tolerance, ranging from aggressive to conservative.

|

|

|

|

By rebalancing your investment portfolio, you maintain your original target asset allocation strategy while allowing you to make adjustments if your investing style happens to change. Rebalancing is a powerful tool to help you stick to your investment plan, regardless of what the market does, to reduce risk and increase your returns.

Learn More About Rebalancing Your Portfolio

Our Precious Metals Specialists can help determine how best and how often you should consider rebalancing your investment portfolio. For more information about retirement and financial planning, call one of our Precious Metals Specialists at (800) 694-3518.