Making Sense of Fed Policy from Jackson Hole

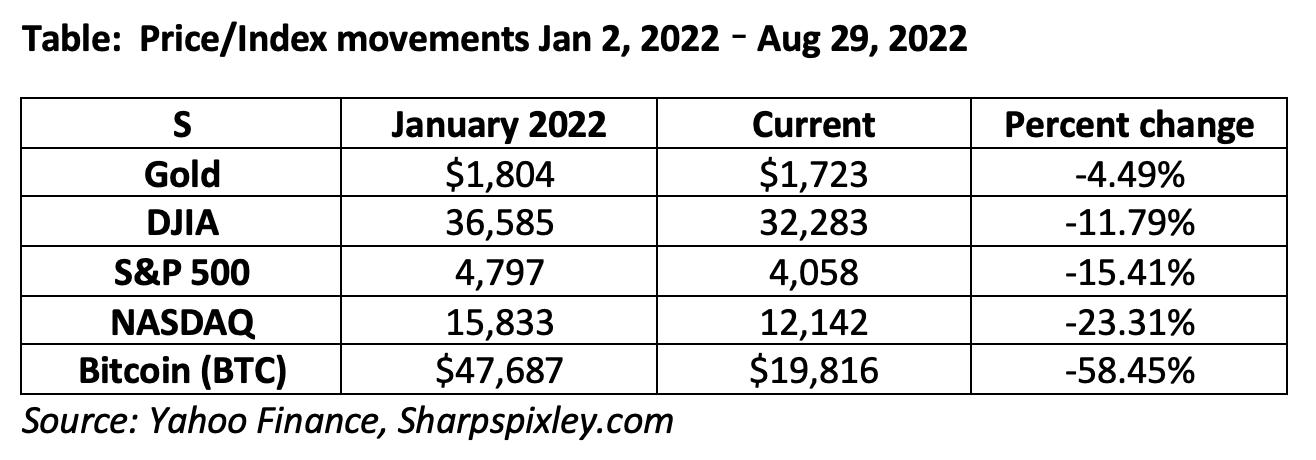

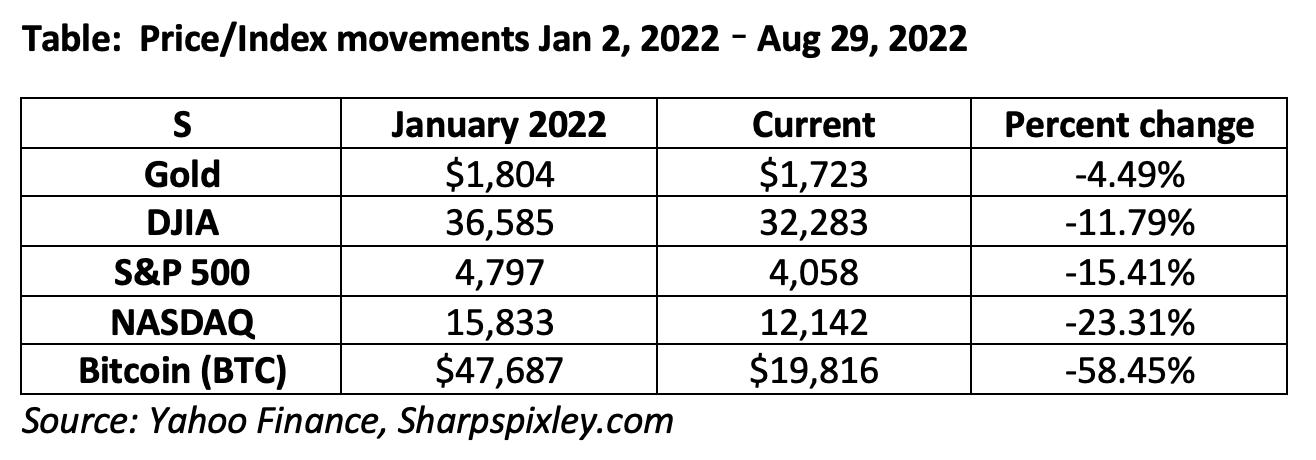

The past few days have seen data releases and events that have had huge significance for the markets and have driven them in a solid downward direction. I suppose that’s what fear of an impending recession means for the investment community, although one might have thought precious metals should have been immune to this kind of downturn under such circumstances. But, they too have fallen significantly on higher interest rate fears, although gold, in particular, by not nearly as much in percentage terms as equities and bitcoin.

As far as a U.S. recession is concerned, the latest data has at least confirmed a small GDP downturn in Q2 – 0.6% as against 0.9% indicated in the earlier preliminary figures. This follows the unexpected 1.5% GDP drop in Q1. Technically two successive quarters of declining GDP is the definition of a recession, but the small Q2 negative assessment to date means that the recession deniers, amongst whom we need to count President Biden and Fed chair Powell, are unlikely to change their tune for the moment at least.

Some aspects of the economy have indeed been healthy enough so far to give their arguments some credence. With the Fed seemingly bent on an aggressive approach to quantitative tightening and higher interest rate impositions, it may not be too long, though, before even these positive aspects of the economy start turning down and the R word can no longer be swept under the carpet.

Other key data releases, including the Personal Consumption Expenditure (PCE) inflation index, were largely inconclusive, with a lowering of the headline rate by 0.1% on the previous month’s figure, balanced by a similar-sized rise in the core rate month on month. However, many commentators seized on the year-on-year rate fall of 0.5% compared with the prior month’s figure, which they took as a perhaps premature sign that inflation may have already peaked. Fed chair Jerome Powell’s address to the Kansas City Fed’s Jackson Hole economic symposium was perhaps more informative as to his, and the Fed’s, likely intentions than normal and largely set the tone for the market mayhem that followed.

This address had been eagerly awaited by the markets as perhaps giving a guide to likely Fed policy at September’s FOMC meeting, but this was still going to be 26 days away – an eternity in Fed economic decision making. Powell’s speech was partly anticipated in preaching a continuing aggressive approach to interest rate rises as a measure for bringing inflation down to its pie-in-the-sky 2% level. The apparent strength of his opinions on this occasion, though, was more than sufficient to knock the markets down several notches.

Powell’s speech, and the initial analysis thereof, was obviously a major disappointment for investors in almost all categories.

There had been hopes of hints of a Fed pivot to a less aggressive approach, but this was not to be. Precious metals all fell sharply and equities and bitcoin even more so. U.S. markets, at last, seem to be taking account of what look to be the severe economic trials and tribulations that potentially lie ahead.

If indeed the Fed remains as aggressive in its approach to trying to bring inflation down as Powell was interpreted as suggesting in his speech, then another 75 basis point increase in the Federal Funds rate seems likely to be imposed at September’s FOMC meeting and a continuing aggressive 50 or 75 basis point rise at the following November meeting too. A series of rate increases of these magnitudes would be yet another contributor to driving the U.S. economy and markets downwards and into almost certain recession, whatever the deniers may tell you.

Inflation is likely to remain a problem whatever the Fed tries to do to bring it down. Some of the key elements are outside its control in any case – notably global energy and food prices which have been hugely exacerbated by the Russia/Ukraine war and while the U.S. is largely self-sufficient in both, it is not immune from the effects of global price trends on domestic prices. It is, though, probably in a better position in this respect than most of its European allies, many of which had previously been hugely reliant on Russian oil and gas exports, which has been one of the most important factors contributing to the seemingly ever-strengthening U.S. dollar.

While higher U.S. interest rates, which now look as though they may exceed 4% by the year-end as opposed to near zero at the beginning of the year, weigh heavily on gold and silver prices, they have been having an even stronger effect on risk-on assets like equities and bitcoin. This is yet another pointer to the U.S. economy entering recession territory, if it is not already there. And the Fed looks to be purposely contributing to this, rather than trying to ward it off. A U.S. economic contraction may actually suit the Fed as part of its anti-inflation battle.

An extended period of economic pain, which Powell seemed to be forecasting, will help to bring home the reality of the U.S. economic position.

The Fed sees inflation as even more of a long term problem than the threat of a temporary economic downturn and a mild recession. The question is, though, can the Fed control things so that a mild recession doesn’t turn into something worse. The jury is still out on that.