Will the FDIC Be Able to Handle a Banking Crisis?

The FDIC (Federal Deposit Insurance Corporation) is an independent agency of the United States government. The FDIC claims to insure bank deposits of up to $250,000 per bank if the bank were to fail. Despite a popular misconception, the FDIC will not insure multiple accounts for $250,000 each. Instead, the insurance is for the depositor’s total at an insured bank. If there is $150,000 in checking and $150,000 in savings, there is $50,000 uninsured. However, the FDIC will insure the deposits at different banks. A depositor could have $250,000 at two or more different banks, and the FDIC would cover it. There are exceptions and situations where the FDIC will insure more than $250,000 for a depositor at a single bank. Details can be found here.

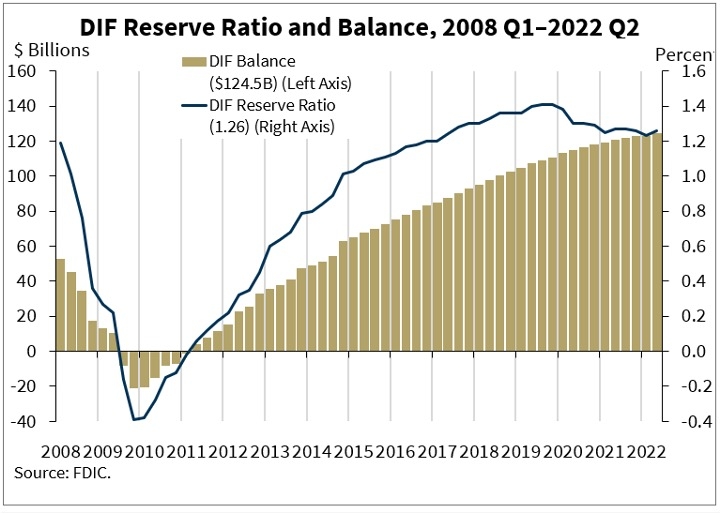

There is more than $22 trillion in the U.S. banking system. Is the FDIC funded for $22 trillion if there is a systemic collapse or if multiple banks fail simultaneously? The FDIC has $124.5 billion on its balance sheet and a line of credit from the U.S. Treasury for $100 billion. FDIC assets would cover only 1.26% of current deposits. The additional $100 billion line of credit would equate to about 2% of all deposits. The FDIC's current balance sheets and financials can be found here. If an entire football field is the responsibility of the FDIC, they can only cover the endzone line to the two-yard line. To understand how this works, we need to discuss the 2008 financial crisis and the Dodd-Frank act.

In 2008, several banks were considered “too big to fail.” Somewhere between $700 billion and $16 trillion (depending on how you interpret government accounting) was funneled to the large banks via the Troubled Asset Relief Program (TARP). Lehman Brothers Bank was the 4th largest investment bank and became the most significant chapter 11 bankruptcy in American history. The money came from outside of the bank, i.e., the taxpayers. Since the money came from taxpayers, it was called a "bailout." The government wanted to remove the taxpayers from the risk of another bailout and create a framework for "bail-ins." Bail-ins put the risk on the shareholders and depositors of the bank. Enter the Wall Street Reform and Consumer Protection Act of 2010, also known as the Dodd-Frank Act.

The Dodd-Frank Act used an extraordinary term for executives and depositors, unsecured creditors. Also, the Dodd-Frank Act changed the legal structure of the FDIC to take receivership in a bank bankruptcy.

What is receivership? When an individual or company declares bankruptcy, its assets are put into receivership. For example, suppose an individual declares bankruptcy. The individual will stand before a judge, who takes receivership. The judge will look at all the assets and liability claims. Assume the person has debts of $100,000, but all the assets only total $50,000. The judge would order the sale of the assets and then pay/negotiate with the creditors in priority of payment order. Some claimants will not be paid or will not get paid in full. This position of receivership is now the responsibility of the FDIC.

The Dodd-Frank Act clearly states the order of payment of bank creditors. The FDIC pays in the following order: (1) administrative costs; (2) the government; (3) wages, salaries, or commissions of employees; (4) contributions to employee benefit plans; (5) any other general or senior liability of the company; (6) any junior obligation; (7) salaries of executives and directors of the company; and (8) obligations to shareholders, members, general partners, and other equity holders. Numbers 7&8 are considered unsecured creditors and can not be paid until all other claimants are paid first. Also, the Dodd-Frank Act allows between 3-5 years for the FDIC to complete a liquidation. In a significant banking crisis event, it could be years before depositors get paid their money if any money is left to pay them.

If a bank goes bankrupt, the job of the FDIC is to distribute the bank’s assets and negotiate with creditors. Here is the scary part. Why are depositors paid last, and why are they called unsecured creditors? Part of the job of receivership is negotiating with creditors. The FDIC's job is to negotiate with unsecured creditors. If the money is insured for $250,000, wouldn't a better term be "secured creditors?" Is anyone insured for $250,000 or just “up to” $250,000? Payment would be negotiated and first come, paid according to priority. In a controlled situation with only one small to medium size bank failing, the FDIC can manage the bankruptcy and pay every depositor. However, bank runs are not well-organized and easily managed events. If another banking crisis the size of 2008 happens, the FDIC is not financially ready to pay the claims.

The sad truth is that trusting the FDIC’s funding is like trusting social security to be there. It is entirely unsustainable, and eventually, a crisis will arise that the FDIC won’t be able to solve. It is better to be prepared and know you will be okay than to put your trust in the government to save your finances. In a cataclysmic economic event, the likelihood of a bank run is very high. Governments historically don’t behave well during banking crises. In 2004, Cyprus had the strongest currency on the planet. It was 2.5 USD for 1 Cyprus pound. Shortly after, Cyprus joined the European Union and adopted the Euro. By 2012, Cyprus almost bankrupted Europe, and a bank run happened. The government seized 47.5% of all assets above €100,000 from banks. Also, the response to the bank run was that depositors could not pull more than €300 out of their accounts. Cyprus went from the strongest currency on earth to a bank run in eight years, and people couldn’t access their money. The primary problem in Cyprus banks was bad debt ratios. The entire U.S. has a bad debt ratio.

Owning physical gold and silver is like an insurance for your money. Gold and silver are not insurance like the FDIC, which is called insurance, but act as the bankruptcy receiver. Gold and silver are similar to actual insurance that is easy to cash out whenever needed. Gold and silver are highly liquid and considered currency agnostic. If the economy goes entirely south and you need money in a hurry, gold and silver can be turned back into every currency on planet earth. In the event of a bank run, bank websites will probably be shut down. It will be necessary to go to the physical branch to get money. If it were to come to it, would you prefer to liquidate gold and silver or stand in line to file an FDIC claim and then wait years to get a portion of your money back?

The choice is yours. You can keep your money in the bank and hope for the best or get your excess cash out of harm’s way with precious metals.