Markets Fell Last Week

Fed chair Jay Powell’s speech to the Kansas City Fed’s high-powered Jackson Hole economic symposium seems to have set the cat among the pigeons. Powell’s presentation was short but very much to the point, seemingly completely dashing the market’s optimists’ hopes of a forthcoming Fed taper at this month’s FOMC meeting, which was just over two weeks away at the time. Indeed Powell seemed to be predicting an even more hawkish approach to interest rate rises at the event in its fight to try and bring inflation down to what I see as a still hugely over-optimistic 2% target.

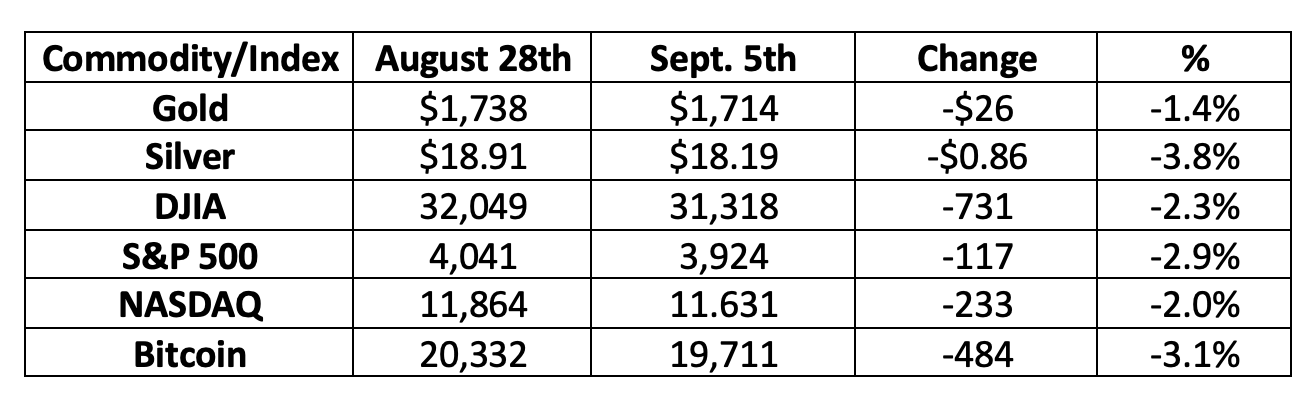

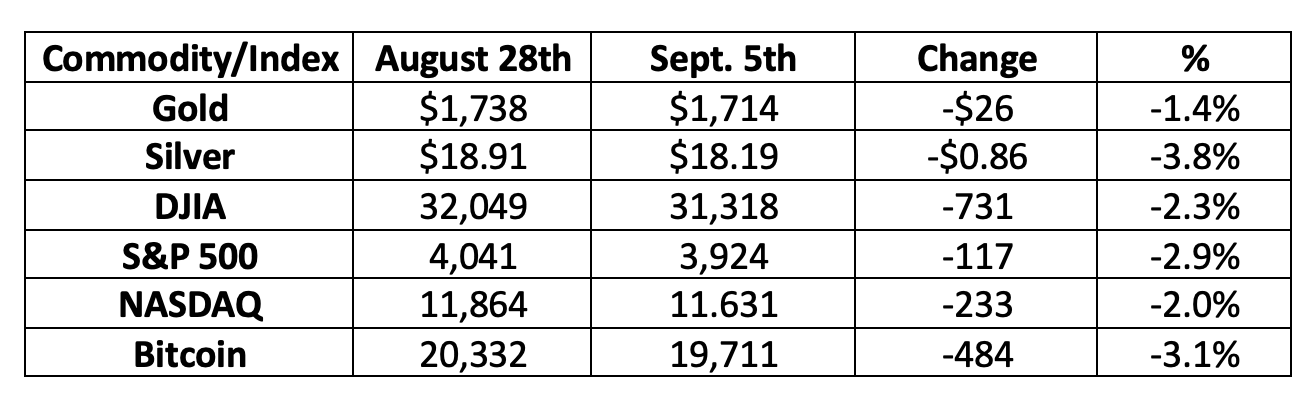

As seen from the above table, all the major U.S. stock indexes moved down around 2% over the past week, as did bitcoin. Gold suffered a similar fate but made a late recovery on Friday and this morning, recovering some of its lost ground. Silver fared a little worse but is an anomaly and tends to be more volatile on both the downside and the upside. It performed more strongly than gold over the past couple of trading sessions but not sufficiently to counteract its earlier sharper losses.

As I have averred in my articles beforehand, some of the inflationary influences, notably those generated by the Russia/Ukraine conflict, which have included higher energy and food prices, are completely outside any degree of Fed control. However, oil prices had seemed to be coming down a little which could be a positive sign as may be food prices now some Ukrainian grain exports have resumed.

We do see some of the ultra-high year-on-year inflation rate comparisons falling quite sharply which may generate some market recovery as this could give the possibly false impression that inflation has peaked. But such year-on-year overall figures could well be irrelevant as inflation rates were building rapidly in the tail half of 2021, so we can expect comparative totals for 2022 to drop drastically as the year progresses. Rather keep an eye on the core month-on-month inflation statistics.

Only if these start to reduce significantly can inflation be said to be past its peak. And even if, and when, these do start to come down because of Fed action, inflation will probably continue to remain at a relatively high level purely because some pressure on energy and food prices will remain for as long as the Russia/Ukraine conflict carries on – and there’s no sign yet of this coming to a rapid end.

On that salutary note one must look in detail at what the Powell-led Fed is proposing. Powell seems to have dropped his talk of a soft landing and to be heading for a more aggressive counter-inflationary strategy altogether involving higher rate increases at forthcoming FOMC meetings – or at least that is the conclusion the markets seem to be coming to for the moment. A more aggressive interest rate policy would also likely contribute to the onset of a recession - if we are not already in one. Powell had been suggesting previously that the Fed would ward off such an economic turndown – but perhaps no longer. It now looks like a Fed-stimulated recession might be becoming yet another weapon in the armory for its attempts to bring down inflation.

The Chicago Mercantile Exchange (CME)’s Fedwatch tool is probably the best market indicator of interest rate expectations and this had moved to being very strongly suggestive that the Fed would raise interest rates by at least 75 basis points (3/4%) at September’s FOMC meeting.

The September FOMC meeting is still nearly a couple of weeks away and expectations could change rapidly, especially if the September 13th Consumer Price Index (CPI) release comes in better than currently anticipated.

Indeed expectations have eased somewhat in the past few days with the Fedwatch prediction having come back to only a 60:40 ratio in favor of a 75 basis point increase over a 50 basis point one at the FOMC meeting. It had earlier been 75:25 in favor of the higher rate rise!

There are thus still expectations that Fed policy is moving towards setting rates high enough to drive down equity prices thereby further stimulating the onset of at least a technical recession in the U.S. as an aid to helping bring down inflation. It calculates, though, that employment strength could be sufficient for it to continue to claim a degree of downside limitation thereby saving face, although this probably cannot continue indefinitely. Risk-on assets like equities and bitcoin would remain weak under such circumstances, while the dollar could fall back a little and gold and silver show some consequent strength.

The problem here may be, though, that dollar strength could remain elevated, particularly against European currencies which are certain to be adversely affected by the latest Russian moves further limiting natural gas supplies and perhaps strengthening oil prices again. The U.S. may well be moving into recession, but Europe is almost certainly facing an even deeper one. While I remain positive on gold long term all this will probably delay any reasonable advance in the price further into the future.