Going to Ground | Lows and Highs of the Dollars and Gold

In spite of plenty of things to invest in all around us, sometimes the best opportunities are found underground. With gold near record highs and moving higher, and the dollar near 13-month lows and moving lower, the recent strategy of exchanging dollars for gold has proven to be an effective way to protect purchasing power. Even a country as obscure as Ghana (in Africa) is now bypassing the use of the dollar when importing petroleum products. Using gold has allowed Ghana to reduce inflation and prevent shortages of oil, gasoline, and diesel fuel. Local politicians have vowed to expand the use of gold to trade for other goods and services, further decreasing the need for dollars in reserve or for trading purposes. The recent success in Ghana using gold for oil provides a roadmap for Americans as well, who also need to protect purchasing power in a dollar-centric world.

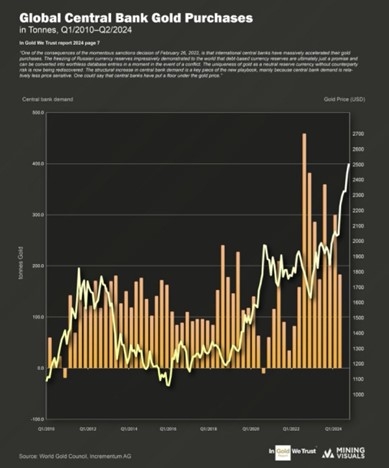

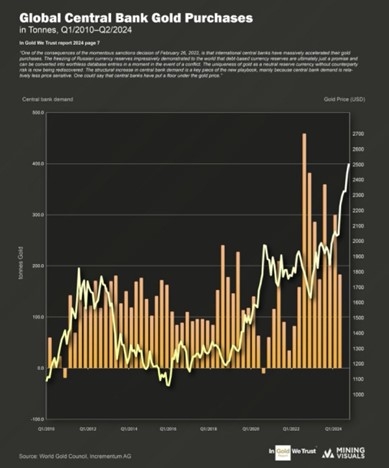

Central Banks Going to Gold

Normally Ghana’s currency (Ghanaian cedi) doesn’t carry much weight, currently valued at $0.06 on world markets.

But when they use those cedis to purchase gold, and then dedicate a portion of that gold for future oil purchases, they are able to transact business in their own currency (cedi) without using dollars - because the cedi becomes implicitly backed by gold for trading purposes. It used to be that all oil purchases and sales were done using dollars, thereby requiring most nations worldwide to maintain dollar reserves. Since everyone had a store of dollars, it was also convenient to use dollars to transact other business as well. But after holding dollar assets became a liability on the world stage, nations began looking for ways to bypass the dollar when trading with one another.

What does this mean for us as Americans, and what can we learn from Ghana about protecting our ability to purchase necessary items in the future? Thankfully for us, most items we need can be purchased directly with our own currency (the dollar). The challenge in an inflationary environment, of course, is in having the quantity of dollars needed to make the purchases. If we use the official CPI(w) numbers as the gauge to measure inflation, which is the metric used to determine COLA rates for retirees, inflation has risen 22.26% (when compounded) over the last 5 years. This means it takes $122.26 today to purchase what $100.00 would buy 5 years ago. As the above-linked article discusses, we all know actual inflation is often higher than “official” inflation, but it is a good place to begin the discussion.

For nations holding dollars in their reserves, today they would need 22.26% more of them to purchase the same amount of goods and services. Most Americans hold dollars in their reserves as well, and need 22.26% more of them to keep the same lifestyle they enjoyed 5 years ago. But for nations (and Americans) who exchanged dollars for gold 5 years ago, that gold can be converted into 65% more dollars today. Another way to say this, is that it only took $64 worth of gold purchased on this date in 2019 ($1,528/ounce) to equal $122.26 of purchasing power today ($2,523/ounce).

Cheaper to Store Savings in Gold

Which is easier to set aside for savings, $64 or $122.26? In order to replicate the 2019 spending power of $100 today, you would have needed to set aside $64 to purchase gold, or $122.26 to leave in currency. In other words, it cost nearly twice as much when saving in dollars, as it did when saving in gold. Even if you saved your dollars in a typical savings account earning a typical 0.49%, you would have needed to set aside $119.30 in 2019, to spend the 2019 time-valued equivalent of $100 in 2024. It is often simply more efficient to store a portion of your savings in gold, than to leave it all in currency for the long term.

What About Stocks?

Something we often hear from financial news media, is that we need to own stocks in order to keep up with inflation. Looking back to September of 2019 we see the Dow Index was at 28,538, compared to 41,090 today. This is an increase of 44% in 5 years. But when official inflation rates indicate we need 22.26% more dollars to have the same purchasing power as 5 years ago, the +44% return on stocks becomes only a 21.74% gain in terms of purchasing power. But we would likely have to pay taxes on the 44% increase, even though over half of it was simply the results of inflation and loss of purchasing power of our currency.

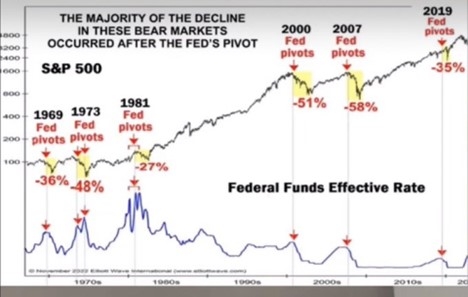

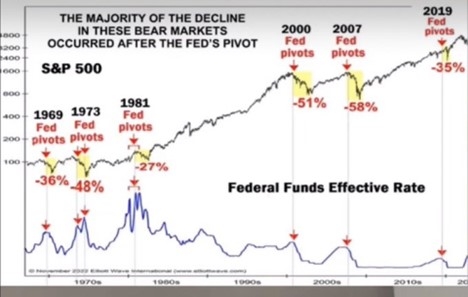

To get a 44% net return would have been easier from owning gold, when subtracting the rate of inflation from gold’s 65% gain. At 42.74% net, it is almost 44%, and 21% more than the net return from owning the stocks in the DOW. The DOW has recently been performing better than the S&P 500 index, but who knows whether or not it will continue to outperform the S&P. What we can be relatively sure of, however, is that they will both likely lose ground after the Federal Reserve begins to lower interest rates. After a brief move higher, most significant market downturns happen in conjunction with the initial pivot of the Federal Reserve (see chart below). This pivot is expected to occur within the next couple of months.

In times of falling markets, uncertain political climates, and increasing war drums beating ever more loudly around the world, sometimes the best approach is to go to ground. That’s where the gold is. Gold has provided financial security for millions of families worldwide over the last 5,000 years or so, and can certainly provide purchasing power insurance for millions of Americans over the next 20-30 years as well.