Current Events and Precious Metal Prices

Many people intuitively know that interest rates, oil prices, and current events affect precious metal prices. However, beyond acknowledging that they are somehow correlated, most people don't know how they affect prices. This article will briefly explain how interest rates, oil prices, and current events affect precious metal prices. Several in-depth articles about the different issues can be found here.

Before discussing individual forces in the economy, we need to discuss the economy first. The economy is a fickle creature. Sometimes the economy behaves as expected, and sometimes it is irrational, like a two-year-old throwing a temper tantrum. Ultimately, most economic movements are a result of supply and demand forces. Supply and demand can keep prices stable, cause prices to rise, or cause prices to fall. There are a few ways to consider how supply and demand affect prices.

Suppose there is a strong demand for an item but not enough supply. People would be willing to pay a higher price to get one of the limited supplies. Some describe this phenomenon as "too many dollars chasing not enough goods."

Another scenario would be the opposite. Suppose there is an ample supply of something but a very weak demand. The price would decrease like a product clearance rack at a discount store. The store makes the prices lower to attract people to buy. Some would say, "there aren't enough dollars chasing the goods." When supply is in balance with demand, the price usually remains stable.

Marketers constantly try to predict sales and find the correct balance between supply and demand. The banks setting the price of precious metals are doing the same thing. The banks are trying to find the price that balances supply and demand market forces.

Current Events

Most people respond emotionally to current events. Suppose a prominent news channel reported a shortage of precious metals or a war broke out. Everyone would immediately call the U.S. Gold Bureau to get all the precious metals they could. The sudden surge of buyers, even if the media report was mistaken, would put upward pressure on the prices. The demand can suddenly surge, which leaves the supply side trying to keep up. However, it can go the other way too. In this scenario, there are too many dollars chasing too few goods.

Suppose a news story broke stating that the Federal Reserve would infuse $5 trillion into the stock market. Precious metal prices would drop because people would want to invest in the stock market. The market would reprice precious metal prices lower because the expected demand decreased. In other words, not enough dollars were chasing the goods.

Oil Prices

Oil prices have a strong correlation to precious metal prices. Precious metals are mined, and the mining process requires large amounts of petroleum throughout the entire process.

There are big land-moving machines to dig the mines. Extensive concrete supports need to be built to support the mines. Air conditioning units need to be made in the mines, and electricity is necessary for the workers to work and see. The precious metals will be transported multiple times to the refiner and then to the retailer. The refiner or mint will need to use large amounts of petroleum to mint, mold, or cast the metal into a usable shape.

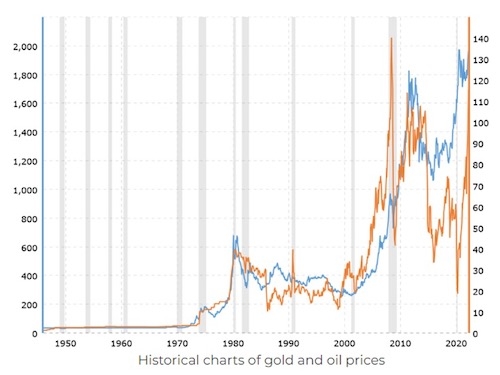

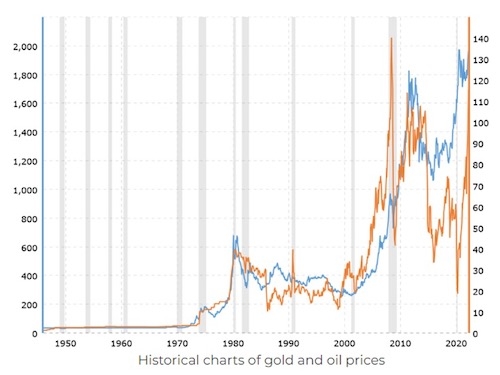

The chart shows that oil prices and precious metal prices generally move together. Over the last 50 years, higher oil prices translated 80% of the time into higher precious metal prices.

However, the chart also shows that lower oil prices don't always equate to lower precious metal prices. Usually, higher oil prices often translate into higher precious metals prices because it means higher production costs.

Interest Rates

Interest rates can be trickier to understand and predict. Interest rates affect precious metals indirectly, and it is not always immediate. Interest rates are a fancy way of saying the cost of money. Lower interest rates mean borrowing is cheaper, and higher interest rates mean it is more expensive. When interest rates are lower, companies like spending more on research and development. When interest rates are higher, companies usually slow their investments in improving their product or services. To understand how it works, you should understand a little about typical investor behavior.

Stock prices are an estimate of the future earnings of the company. Suppose a company invests heavily in new technologies with a low debt obligation. In that case, the market will usually assign a higher price for future earnings. During periods of low interest rates, most investors chase the stock market. When interest rates rise, companies slow down, and projected earnings decrease. The company is not investing heavily in new technologies; if they are, it is at a much higher price, meaning lower long-term profits. The price goes down. As prices drop, investors rebalance their portfolios into traditionally safer asset classes like real estate, collectibles, and precious metals.

The best time to buy precious metals is when they are cheap, usually at low-interest rates. Lower interest rates keep investors in the stock market. There are not enough dollars chasing precious metals, so prices tend to go down. Investors look for safety in precious metals when interest rates rise, so the prices increase. The most intelligent investors buy low and sell high.

Most people want to buy precious metals when higher interest rates destroy their other investments. It is an excellent move to rebalance to protect the rest of the portfolio. Still, it is like shopping for an umbrella after it starts raining. The umbrella may prevent more rain from falling on your head, but it won't dry off the wet clothes. It is better to have an umbrella waiting than to worry about finding one or the price you may pay after the rain starts. There will be too many dollars chasing too few goods.

Current events, oil prices, and interest rates all affect precious metal prices in the short term. Still, precious metals are a long-term strategy to protect purchasing power. Sometimes the day's news presents an opportunity to buy precious metals at an attractive price. If a current event offers a buying opportunity, stock up. However, the best strategy is to have a plan. Most people want 5-20% of their portfolio invested in precious metals.

Some people want to buy all the metal at once, but most want to dollar cost average over time. They buy a healthy amount at first and then add it to their portfolio at regular intervals, like weekly, monthly, or quarterly. Sometimes, they pay a little more, and sometimes a little less. Overall, it averages out, and the person builds a healthy precious metal portfolio aligned with their financial strategy. You can too.

Free education is just a phone call away.

(800) 695-3518