China: Key to Global Gold Supply and Demand

China is both the world’s biggest producer of and biggest consumer of gold, but its 2020 gold demand has been hugely impacted by the coronavirus pandemic, which started its global spread there. The country appears to have controlled the virus spread well by imposing drastic control measures on virus epicenters – control measures that might not have been tolerated in most Western democracies – but the country’s massive economy was significantly and directly affected by the virus in the first half of 2020. Since then, the country’s financials have picked up substantially, led by exports of COVID-related products in terms of PPE and electronic devices that have been in huge demand in Western markets. Indeed, despite moves by the U.S. administration to try and redress the balance-of-payments situation with China more favorably for the U.S.A., figures for the year 2020 show a further, and rising, substantial trade imbalance in China’s favor. Increased tariffs on Chinese imports have thus had little, or no, adverse effect on total U.S. imports from there. In fact, despite the slow start, China’s GDP actually rose 2.3% over the full year – perhaps not as much as it had been increasing in previous years, but a rise nonetheless.

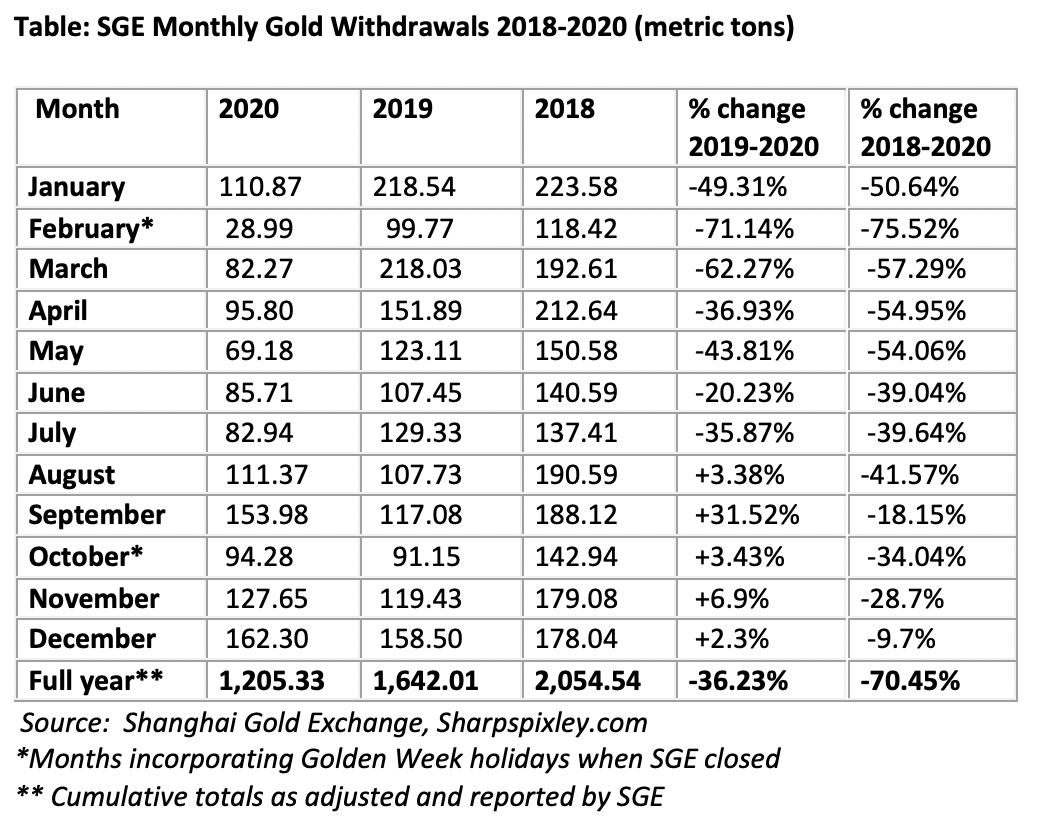

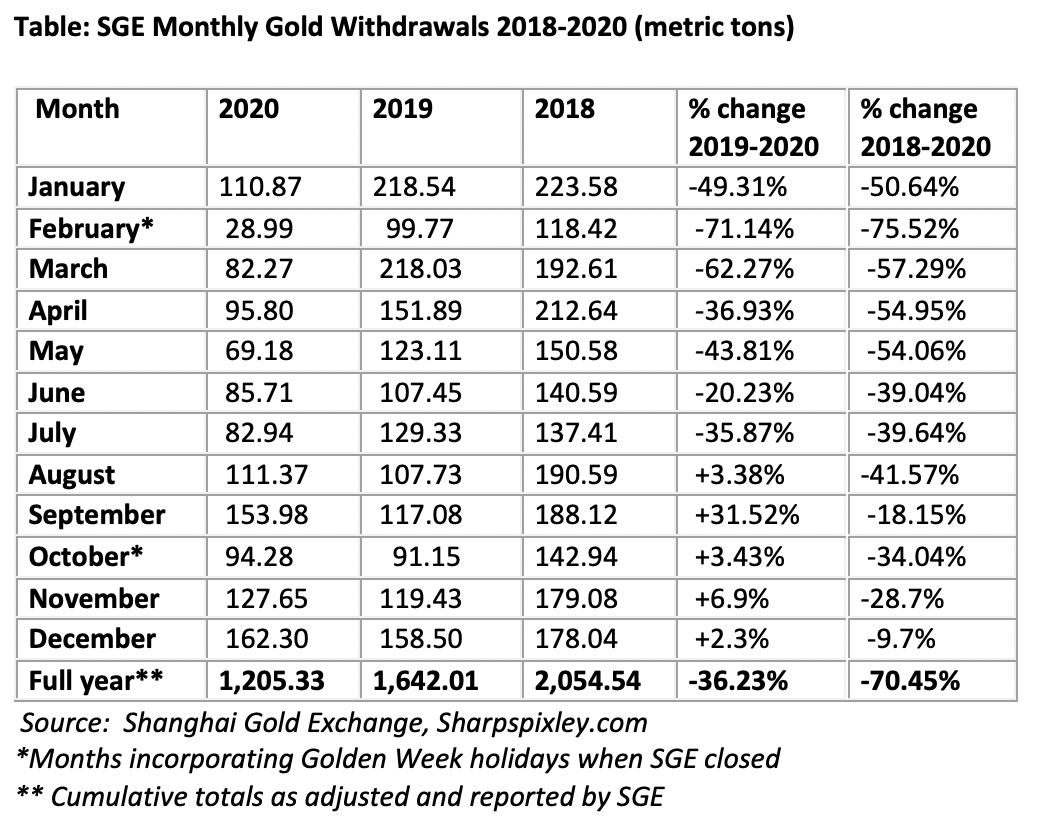

China’s gold demand had also actually been on the decline since the record 2015 year, when it was estimated to have consumed over 2,500 tonnes (metric tons – 1 metric ton is equivalent to 2,024 pounds) of gold. We equate Shanghai Gold Exchange’s (SGE) reported monthly gold withdrawal figures as being a close representation of total Chinese gold demand. This equivalence is disputed by some gold analysts, but we have noted that the volume of SGE gold withdrawals equates closely to the sum of China’s domestic gold production, plus known gold imports from those countries that publish detailed gold export statistics, plus a relatively small allowance for unpublished gold imports and scrap conversion.

As the SGE gold withdrawal figures are published monthly, they also give an excellent view into the ebb and flow of Chinese gold demand. The latest published figures suggest that Chinese gold demand may just be beginning to pick up again. This is welcome news for the gold investor, given that demand from the two biggest elements in annual gold flows over the past couple of years – central bank gold purchases and gold ETFs – appears to be slowing down.

The table below shows SGE gold month-by-month withdrawal totals for the past three years, indicating a continued annual decline. There are now tentative indications, however, that this annual fall in demand may just be beginning to reverse, albeit any recovery is likely to be slow until the global coronavirus pandemic spread is brought under control and global economies recover to previous levels. Even so, December’s figures, which show a year-on-year increase, suggest the nation’s gold traders and fabricators are anticipating a good demand pickup for the Chinese New Year gifting season.

This year, the actual date of the Chinese New Year is February 12th, so, if the trend continues, January should also prove to be a particularly strong month for gold demand in the Middle Kingdom. Indeed, anecdotal reports suggest this is very much the case, and supply is tight enough now for dealers to be able to charge premiums on gold purchases. However, we will have to wait for the announcement of January’s SGE gold withdrawals, due to be announced in mid-February, before such evidence can be confirmed by official figures.

So why is Chinese gold demand so important to the world? At its peak back in 2015, China consumed an amount equivalent to around 80% of the world’s newly mined gold, on its own. If one adds in gold demand from additional gold-consuming nations like India and other Asian demand centers, not to mention North America and Europe, the figures would put global annual gold demand well in excess of new gold supply. Much of the balance will have been taken up by gold scrap recycling buoyed by higher gold prices, but overall, this suggests basically tight gold supply-and-demand fundamentals.

The fall in Chinese gold demand since 2015 was first counterbalanced by central bank buying, but when this also started falling away, mostly during the current year , we saw a massive pickup in metal going into the gold ETF sector. Latest figures now suggest that ETF gold flows may be slowing, or even reversing. However, if this is countered by a rise in gold demand from China and elsewhere - Indian and Turkish gold demand is also looking stronger again, while U.S. demand for Gold Eagle coins from the U.S. Mint suggests North American investment demand for gold bullion may also be decently positive - then increased global bullion investment demand could well counterbalance any fading in gold ETF flows. In other words, gold supply-and-demand fundamentals may be somewhat stronger than any falloff in ETF accumulations might suggest.

It seems highly likely that China’s GDP will outstrip that of the U.S. in the next few years and that possibly the yuan (renminbi) will start to rival the U.S. dollar as the world’s principal reserve currency.

To date, the U.S. economy has been served well by the dollar’s global reserve currency position, but some of this status was already being eroded by bilateral import-export deals conducted in alternative currencies – notably the yuan - and where this includes oil and gas deals, bypassing the petrodollar in which all oil used to be traded. Such shifts are particularly significant.

As far as gold is concerned, we do foresee China building up its demand again year on year, but it may take some time to get back to the kind of record levels seen in 2015. The Chinese do remain attuned to holding gold as a bulwark against future financial problems, so we would expect some degree of gold hoarding to rise along with the nation’s economic recovery. This likely demand will thus be key for gold’s fundamentals in the future.

With global production levels of newly mined gold becoming static – known as peak gold – and the prospect of output actually beginning to fall in the years ahead, given the dearth of major new gold deposits to be exploited and a fall in grassroots exploration over the past few years, supply-and-demand fundamentals look to be remaining tight. U.S. markets still seem to be the main price drivers for now, but the evidence for any falloff in U.S. gold demand remains mixed, with ETF inflows and outflows behaving erratically – although bullion coin purchases from the U.S. Mint remain at a high level, as pointed out above.

I don’t see the recent weakness in the gold price, which has just fallen below its 200-day moving average, continuing – particularly given the enormous levels of COVID-19 infection rises and deaths currently being reported. A Biden administration is likely to implement further control measures , which could further restrict short-term U.S. economic growth prospects and increase stimulus levels. However, at this stage, we still expect equities to weaken and perhaps more of this economic stimulus to find its way into traditional safe haven investments like gold. I thus maintain my forecasts of a plus-$2,000 gold price level later in the current year. I could be wrong, but to me, the downside risks of investing in gold are far less than those of investing in equities or Bitcoin, both of which could be due for major reversals.